Accounting Intelligence and Prospecting From Form 5500 Filings

In addition to providing company-level data, Axiomatic Data provides plan-level data as a data product. Common use cases for the plan level data include:

- Identifying potential clients for financial planning or insurance services.

- Targeting companies that require employee benefits-related services.

- Plan benchmarking: Employers and plan sponsors can compare their plans to industry averages and make adjustments as needed.

Having worked with Form 5500 data for over 10 years, Axiomatic Data transforms the raw Form 5500 filings and schedules into ready-to-consume data products. Axiomatic Data aggregates, harmonizes, and normalizes several million Form 5500 filings each year to create an accurate and robust database that serves multiple use cases. Additionally, the Form 5500 experts at Axiomatic Data are available for custom Form 5500 analytics requests and needs.

Form 5500 Plan Auditors

Generally, employee benefit plans with 100 or more participants (those that file a Schedule H) must include an audit report with Form 5500. If the total participant count as of the first day of the plan year is less than 100, a company generally doesn’t need to include an audit report with its Form 5500.

On the Form 5500 filing, the name of the accounting firm along with its Employer Identification Number (EIN) is included. This information can be leveraged for a variety of use cases:

- Competitive intelligence for accounting firms to identify potential clients and clients held by competitors (not only is the accounting firm identified but the size of the company filing the Form 5500).

- Due diligence for a company looking to engage with a new accounting firm (identify the accounting firms working with peers in its industry or region).

- Holistic view of the accounting industry to identify which accounting firms are growing and shrinking.

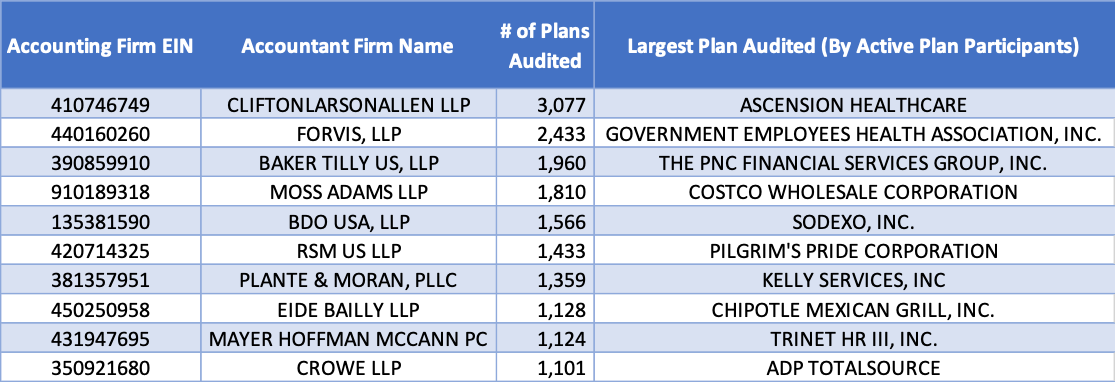

The above figure displays the accounting firms that have audited the most Form 5500 filings during the prior year. CliftonLarsonAllen, the 8th largest accounting firm in the U.S., audited nearly 4% of the total audited Form 5500 Filings in 2022. Note that this table focused purely on the number of filings audited rather than the size of the companies filing, which is why none of the traditional “Big 4” accounting firms are listed. However, total assets in a Form 5500 benefit plan along with employee participation count are available in the Axiomatic Data plan level dataset.

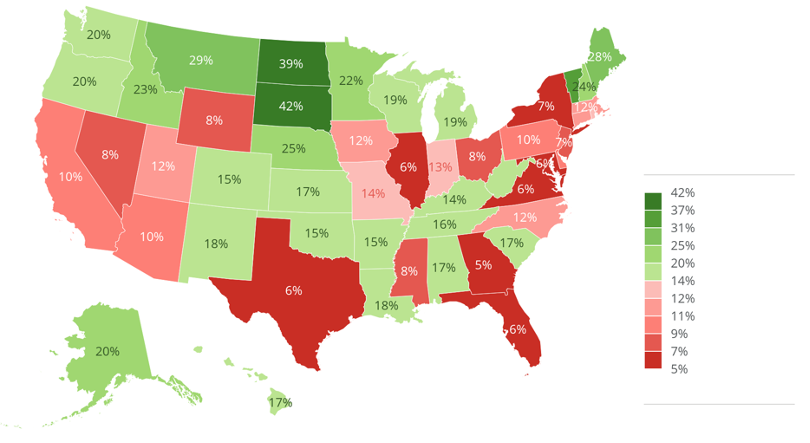

The above figure examines the market share by the most used Form 5500 accounting auditor for each state. Not surprising, states with smaller populations (such as North Dakota and South Dakota) tend to have accounting firms with higher market concentrations.

Contact info@axiomaticdata.com for more information about how your company can leverage Form 5500 data.