An Overview of Axiomatic Data Private Company Data and Prospecting Uses

Key Datapoints Available:

- Firmographic information (Company name, address, phone number, company age)

- Industry classification (Based on NAICS)

- Employee Counts

- Employee and Company pension contributions

- Employee growth rates, a proxy for overall growth of the company

- Pension plan net assets ($)

- Pension plan participation rate

Employment Data:

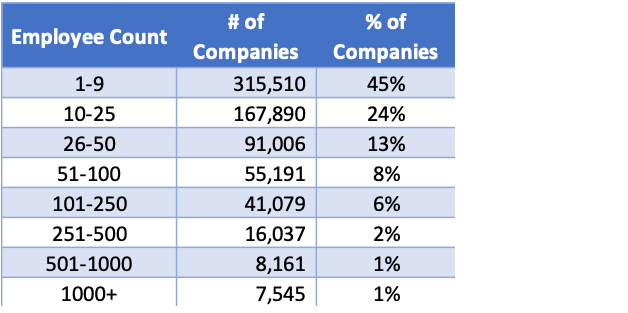

Employment counts sourced from Form 5500 data are considered to be the greater of the number of employees eligible for a pension plan or the number of employees participating in a welfare plan. As the data is sourced directly from Form 5500 filings which have specific requirements and definitions, the data is comparable across companies and industries. Further, as these filing requirements and definitions have been consistent over time, employment counts by company are available in a time series format which allows an analyst to understand growth trends for a company and its industry peers. Table 1 below depicts the distribution of private companies based on current employee count.

Table 1

Firmographic Data and Industry Classification:

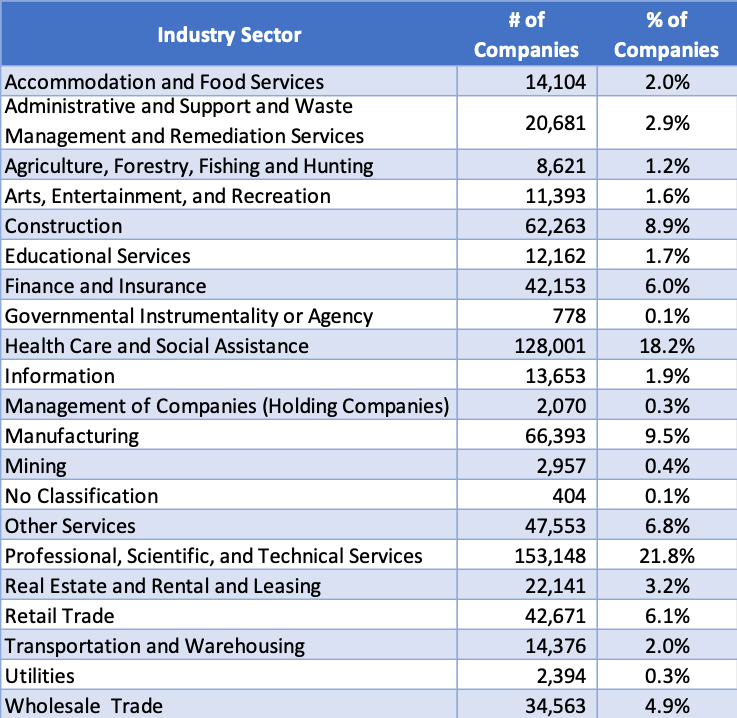

Company name and address are sourced directly from the Form 5500 filings submitted by the companies themselves, ensuring superb quality and accuracy. Additionally, companies self-select their industry classification from a NAICS-based classification. This NAICS classification contains more than 420 industries, 97 industry sub-sectors, and 21 industry sectors. Table 2 below shows the distribution of companies by industry sector.

Table 2

Time Series Data

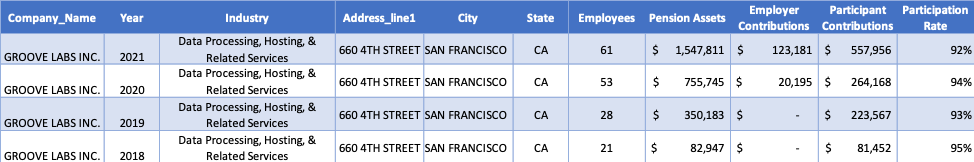

As Form 5500 is a required annual filing that has required consistent data with consistent definitions over time, Axiomatic Data has the advantage of providing consistent longitudinal and time series data. An example of this time-series data is included below. This allows for the computation of accurate growth rates which is a rarity for private company data. An example of this time series data is shown in Table 3 below.

Table 3

Growth Metrics:

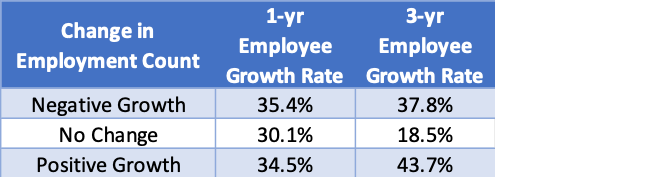

Having consistently defined time series data allows for accurate growth rate variables. Particularly useful are Axiomatic Data’s one and three year growth rates of employment which are an overall proxy for the growth trajectory of a company. These growth rate variables allow for the identification of fast-growing companies for either customer targeting or company acquisition. Table 4 below provides a distribution of companies with decreasing employee count, no change in employee count, and increased employee count over one and three year time periods.

Table 4

Axiomatic Data Potential Use Cases:

- Customer or Acquisition Prospecting

- Identify emerging and growing companies using consistent growth metrics

- Identify companies in specific industries and/or specific geographic areas

- 401K Prospecting for financial advisors/financial advising firms

- Identify prospects in region with large amounts of $ in pension plans

- Company Due Diligence

- Company Benchmarking

Data Sample and Dictionary

Data samples with a corresponding data dictionary can be located here for companies in the states of South Dakota and Rhode Island.

About Axiomatic Data

Axiomatic Data, the Form 5500 Information Company, provides a database and analytic tools for US public and private companies based on Form 5500 filings. The database has history back to 2013 and for the Russell 3000 is point-in-time and mapped to tickers. In addition to using Axiomatic Data as part of financial models for US public company investing, Axiomatic Data is used for ESG analysis, private equity deal sourcing and due diligence, and for comprehensive firmographic information for US companies.