Axiomatic Data ESG Social metrics

Axiomatic has built a consistent, comparable framework with material and auditable ESG factors, extracted from publicly available Form 5500 regulatory filings. Axiomatic Social factors for public and private companies are used to identify socially responsible companies and can be used to create exclusion lists of companies with poor ESG rankings by sector and industry (IRS industry classification) for the social component of ESG. Academic research has shown Axiomatic “social” metrics are highly correlated with corporate performance proving the thesis: Companies that treat their employees well, function more effectively and outperform the market benchmark. Our database is available on an annual subscription basis. Clients receive a backfill of clean, historical, point- in-time data mapped to Russell 3000 tickers (available for testing) and then monthly updates. Price is dependent on use case(s) and AUM. Current customers pay between $30,000 and $100,000 per annum. We continue to work on creating derivative data (like our current ThriveScores) to provide a wider array of signals from the raw data. Our typical customer is a quantitative or quantimental asset manager, with a medium or long-term holding period for US equities. We also cover private US companies where customers range from marketers using our firmographic data to private equity funds using our data for deal sourcing and due diligence. Some of the Axiomatic Data ESG (Social) metrics gleaned from Form 5500 filings include:

- Salary Boost: the level and growth of employer contributions per active employee in a defined contribution pension plan, e.g., 401k plan.

- Salary Deferral: the level and growth of participant contributions per active employee in a defined contribution pension plan, e.g., 401k plan.

- Pension Plan Participation Rate: the percentage of employees participating in a defined contribution pension plan, e.g., 401k plan.

Case Study

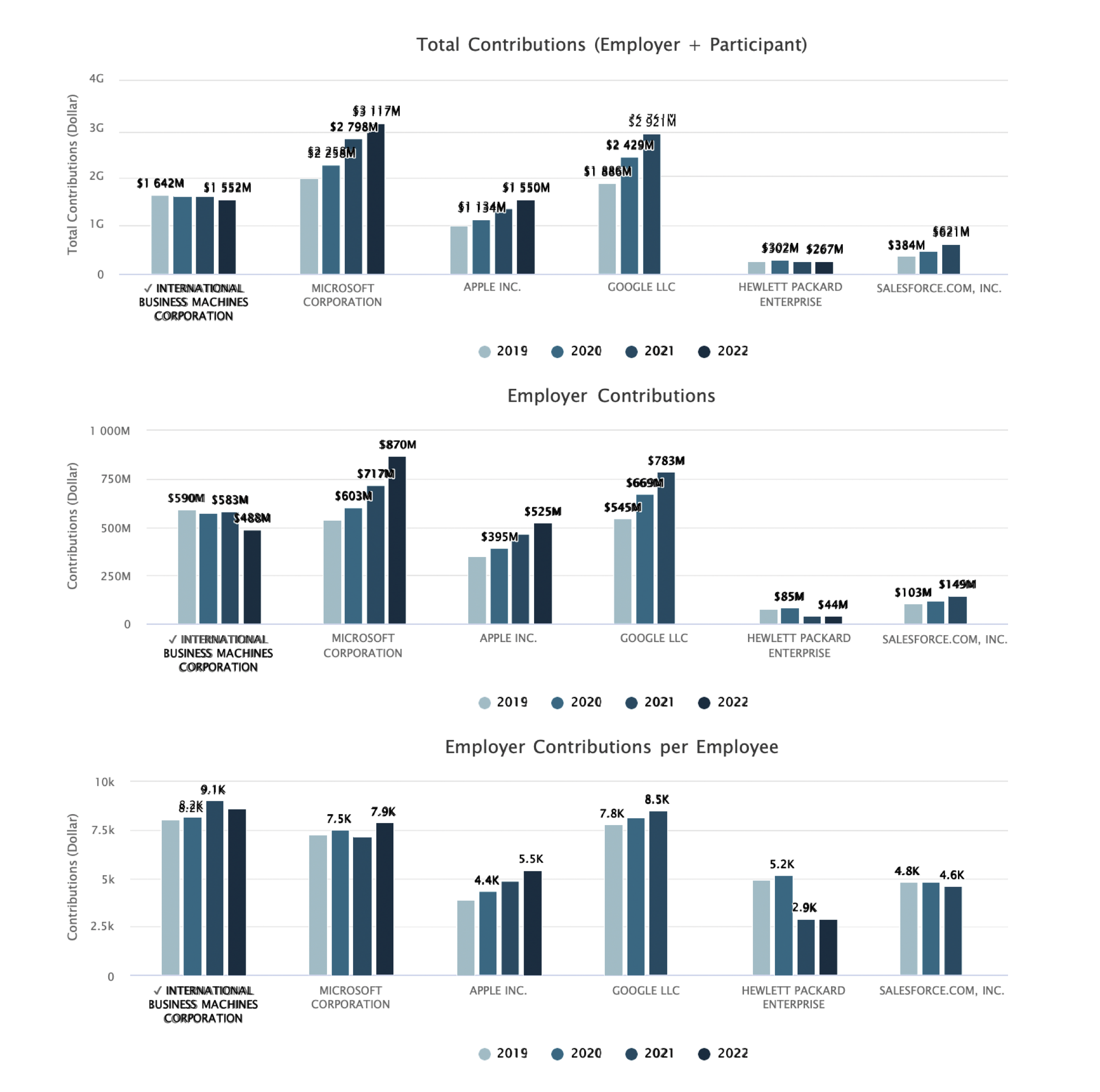

Using Axiomatic ESG Social metrics, we rank some of the highest-rated Technology companies. Most companies in this sector have high levels of Salary Deferral (participant contribution per active employee) and Pension Plan Participation Rates. This is expected, since these companies employ many white- collar, highly compensated workers with excess income to allocate to their 401k plans. However, even among these relatively homogenous companies there is a noticeable spread in Salary Boost (employer contribution per active employee) and employer contributions as a percentage of total contributions to defined contribution pension plans as seen in the figure below. The level and growth of company contributions per active employee have been found to be highly correlated with corporate performance.