Examining A Nudge: Has Auto-Enrollment in Retirement Plans Increased Over Time?

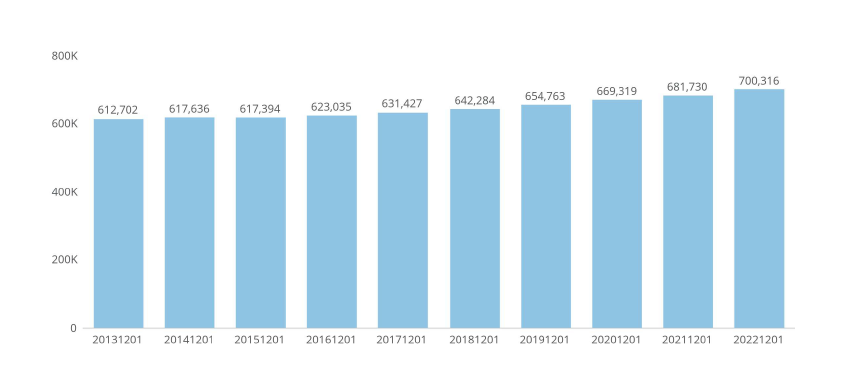

Auto-enrollment in retirement plans is a prime example of a nudge in practice. Traditional economic theory would suggest that if individuals understand the benefits of saving for retirement, they would opt into retirement plans that best suit their needs. However, in reality, many individuals do not enroll in such plans due to a variety of reasons, including inertia, procrastination, or the complexity and overwhelming nature of choice. Chart 1 illustrates the number of companies offering retirement plans to their employees from 2013-2022.

Chart 1: Number of US Companies Offering a Retirement Plan Benefit, 2013-2022

By automatically enrolling employees into retirement plans, employers effectively change the default option. Instead of the default being "not enrolled", it becomes "enrolled". Employees can still opt-out if they choose to, so their freedom of choice isn't restricted. However, the shift in the default takes advantage of the inertia that might have previously prevented them from enrolling. Most people tend to stick with default options because it's often perceived as the suggested or easiest course of action. Thus, by making enrollment the default, it's more likely that employees will start saving for retirement without any active decision on their part.The power of this nudge lies in its subtlety. By merely changing the starting point or default state, auto-enrollment can lead to significant increases in retirement savings rates. It leverages behavioral insights about human nature, particularly our tendency towards inertia and the status quo bias, to promote better long-term financial decision-making.

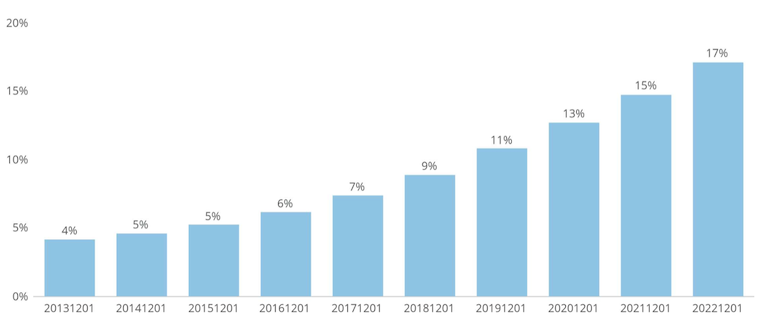

So what does the data say about this particular nudge? Using Form 5500 filings going back to 2013, Axiomatic Data looked at the prevalence of auto enroll among US companies. Form 5500 series is a reporting and disclosure tool used to satisfy annual reporting requirements by public and private companies in the U.S. for employee benefit plans under ERISA and the Internal Revenue Code.

Form 5500 was jointly developed by the Department of Labor (DOL), the Internal Revenue Service (IRS), and the Pension Benefit Guaranty Corporation (PBGC). Employee benefit plans include welfare benefits such as medical, dental, vision, etc. and retirement benefits such as 401Ks and others.

Chart 2 shows that across all Form 5500 filing companies, auto-enroll has increased from 4% of plans in 2013 to 17% of plans in 2022. This covers a universe of approximately 700,000 US companies, both public and private.

Chart 2: Percentage of pension plans with auto-enroll - all Form 5500 filers

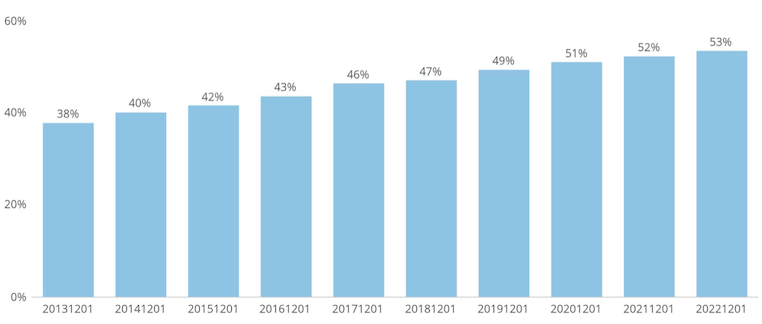

Chart 3 shows similar data for the Russell 3000, where auto-enroll has grown in prevalence from 38% in 2013 to 53% in 2022.

Chart 3: Percentage of pension plans with auto-enroll - Russell 3000

This data clearly shows that auto enrollment is a growing feature of retirement plans offered by US companies of all sizes, from small private companies to companies included in the Russell 3000. The next question we asked was if having auto enrollment noticeably increased retirement plan participation. Even if an employee is automatically enrolled, they can choose to opt out.

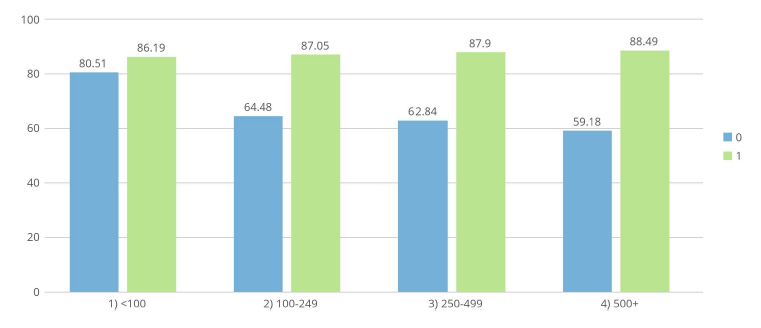

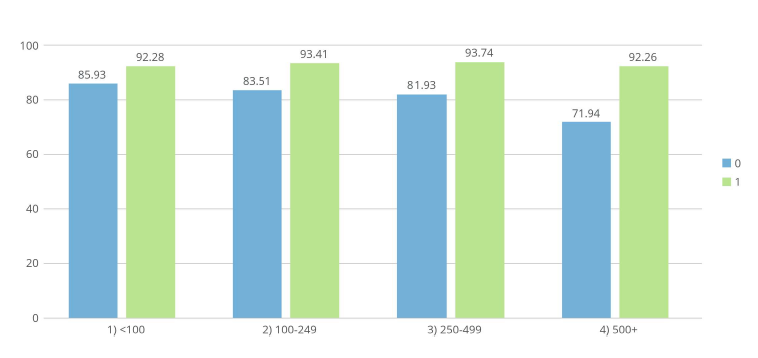

In every case, automatic enrollment leads to higher participation rates. In Chart 4 we show participation rates across the entire universe of filing companies broken down by company size. The blue bars represent the participation rate among companies that do not have auto enrollment; the green bars represent companies that do have automatic enrollment. The chart breaks down the company universe by size, from less than 100 employees on the far left to companies with greater than 500 employees on the far right. The larger the company with an automatic enrollment feature, the higher the plan participation rate.

Chart 4: Participation Rates by Employee Count - Without Auto Enrollment vs With Auto Enrollment, all Filers

For Russell 3000 companies seen in Chart 5, the data is similar. The larger the company is in terms of number of employees, the greater the difference in participation if the company has auto-enrollment.

Chart 5: Participation Rates by Employee Count - Without Auto Enrollment vs With Autoenrollment, Russell 3000

Conclusion

There’s been a significant amount of research conducted since Nudge was published and some of this research has exposed some nudges as ineffective. The data proves that auto-enrollment has noticeably increased participation rates in employee sponsored retirement plans, which will ultimately benefit participants in the future.