Form 5500 Filings: 2021 in Review

Axiomatic Data aggregates Form 5500 filings and extracts, cleans, and harmonizes the data for use by quantitative investors, private equity funds, and other businesses that need employee and firmographic information on US companies.

Who must file a Form 5500?

Any US company, regardless of size, that has an employee retirement plan, or If on the first day of their ERISA plan year a company has 100 or more participants enrolled in coverage, then they will need to file a Form 5500 for their Health and Welfare Benefit plan.

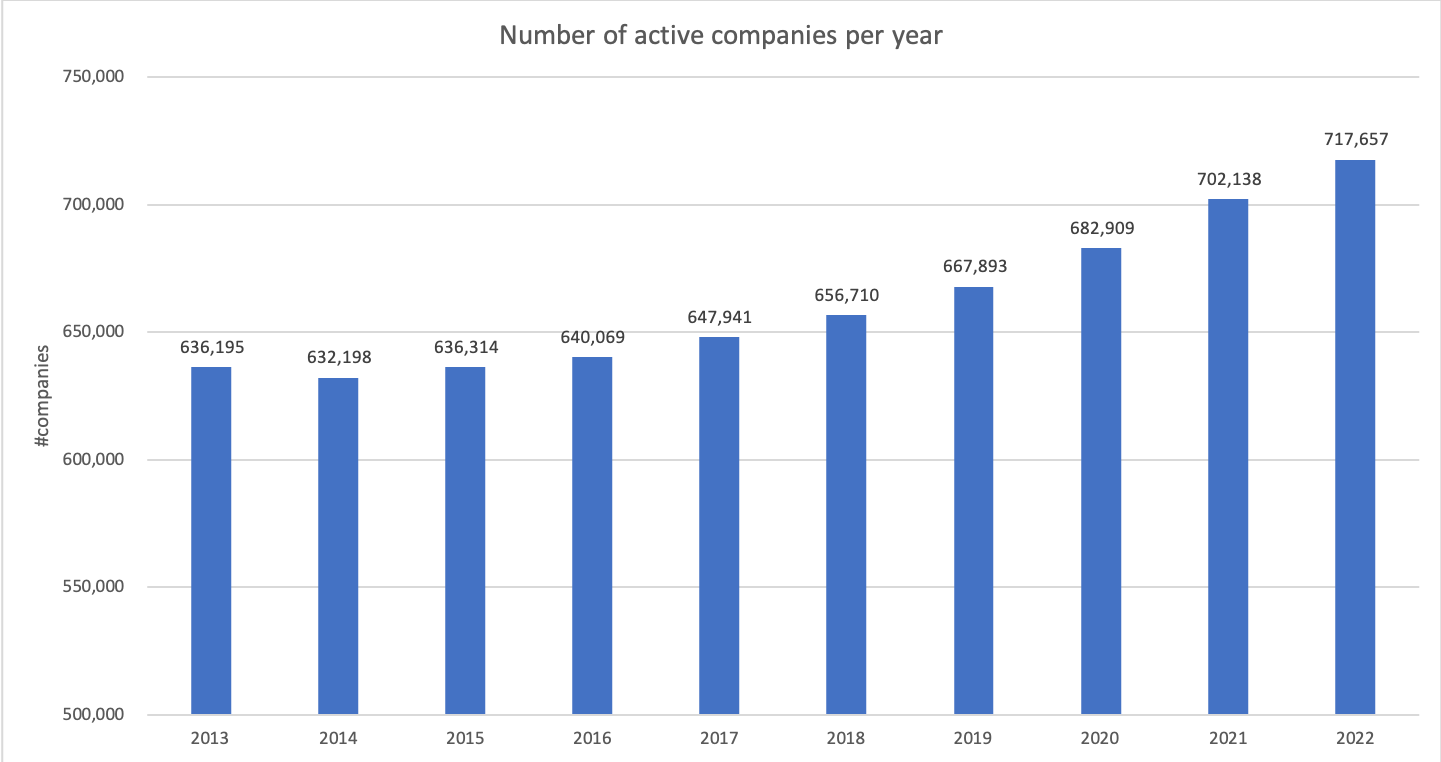

The table below shows the continued uptrend in active companies filing a Form 5500 from 2013 to 2022. So despite COVID-19, active company growth persisted in 2020 and 2021.

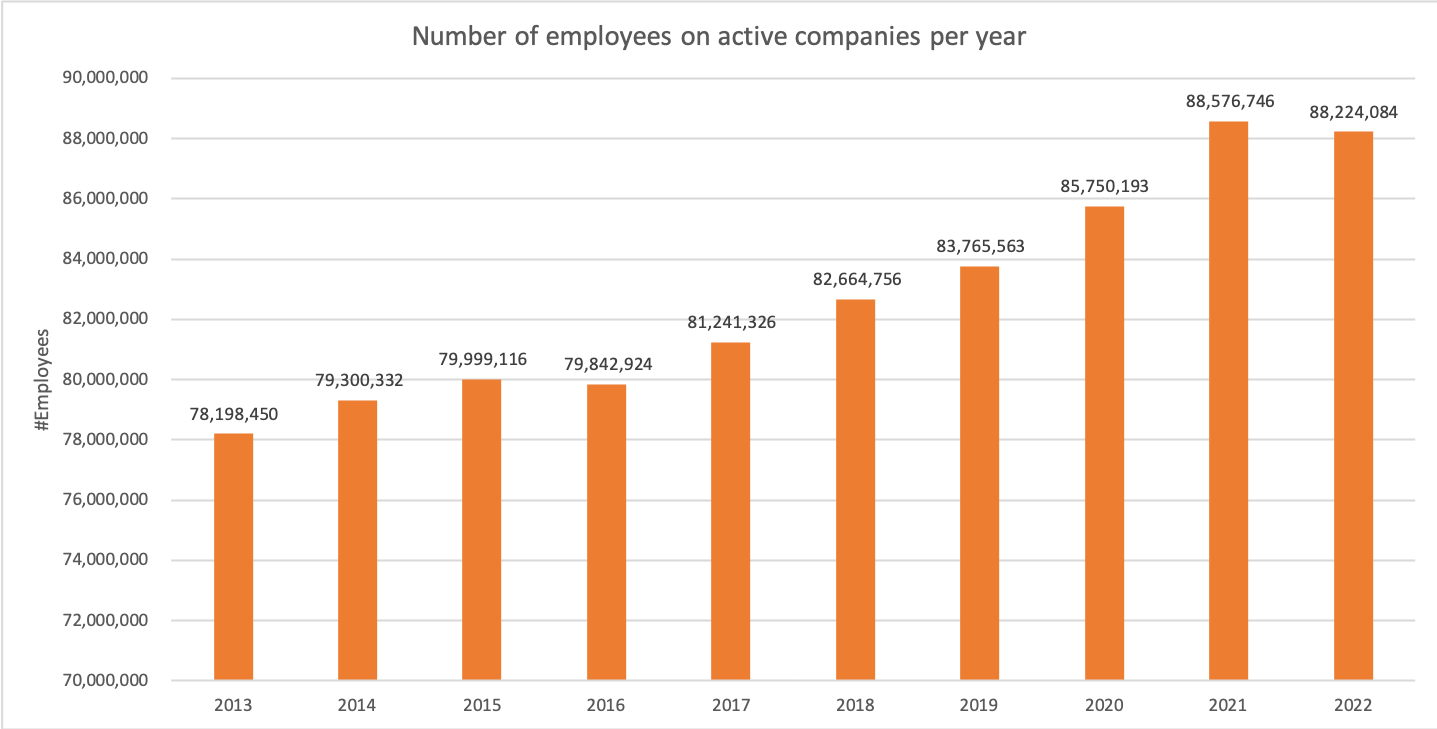

The number of employees enrolled in plans that need to file a Form 5500 actually decreased slightly in 2021. This is likely the result of a combination of factors, from hospitality companies laying off or furloughing workers, to the “great resignation”. At the same time, the “great resignation probably contributed to the expansion in the number of active companies.

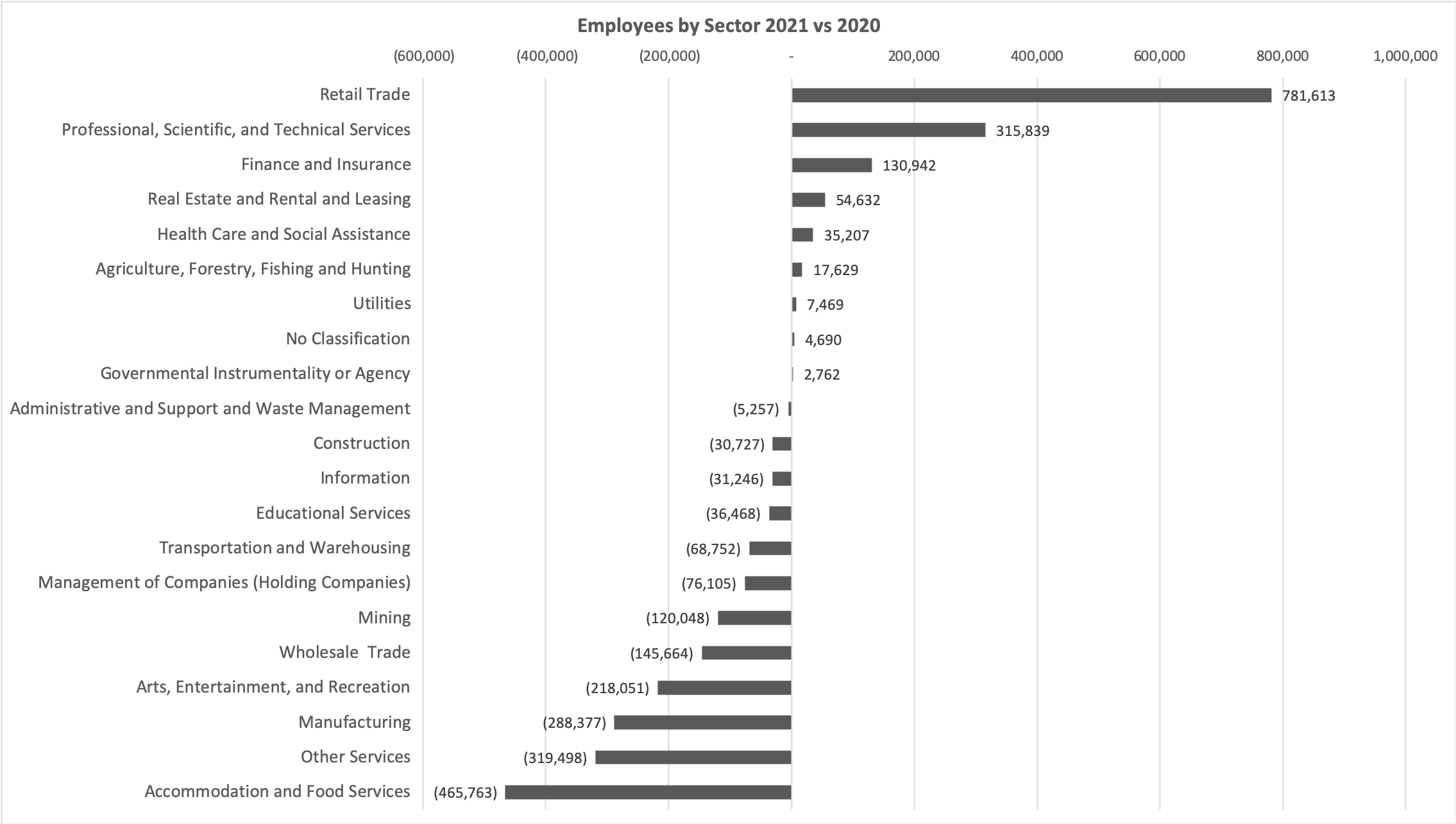

Filers of Form 5500s must indicate the industry group their company is part of, selecting from a list of industries constructed by the IRS. The chart below shows shifts in employees by industry from 2020 to 2021.

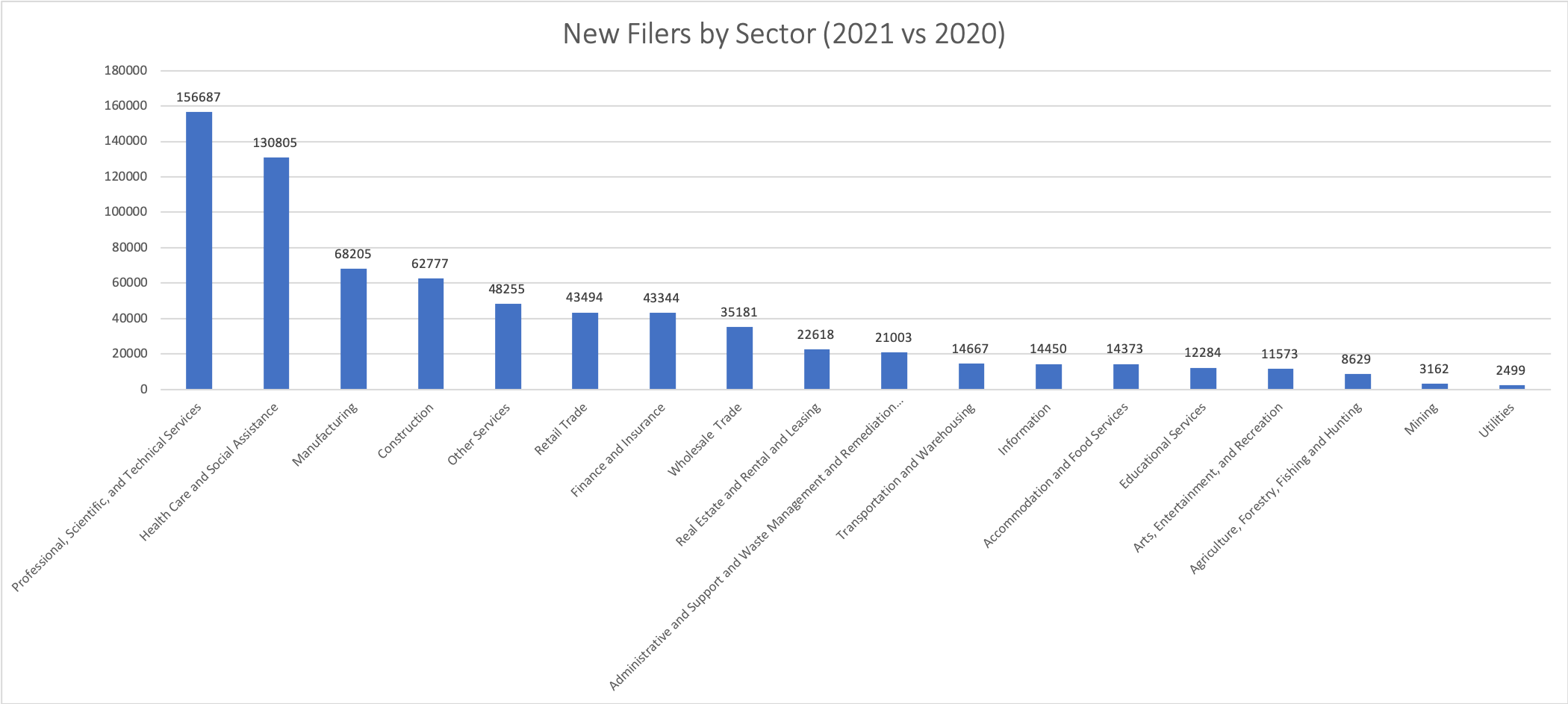

Professional, Scientific, and Technical Services was the leading sector for new filers by a wide margin.

There’s a tremendous amount of information locked in Form 5500 filings that Axiomatic Data prepares for analysis. Next post will describe some benefit-specific information available in the Form 5500 series.