Reconstitution of Russell Indexes 2022

Nearly 300 stocks were added to the Russell 3000 list during the Reconstitution process. Notable companies added to the Russell 3000 were Airbnb (ABNB), Coinbase (COIN), 23andMe (ME), Robinhood Markets (HOOD), Root Inc. (ROOT), and WeWork (WE). Conversely, nearly 300 stocks were dropped from the Russell 3000 list during the Reconstitution process. Notable companies removed from the Russell 3000 were Clovis Oncology (CLVS), Citizens Inc. (CIA), Red Robin Gourmet Burger (RRGB), Kirkland’s Inc. (KIRK), Mesa Air Group (MESA), and Metromile (MILE).

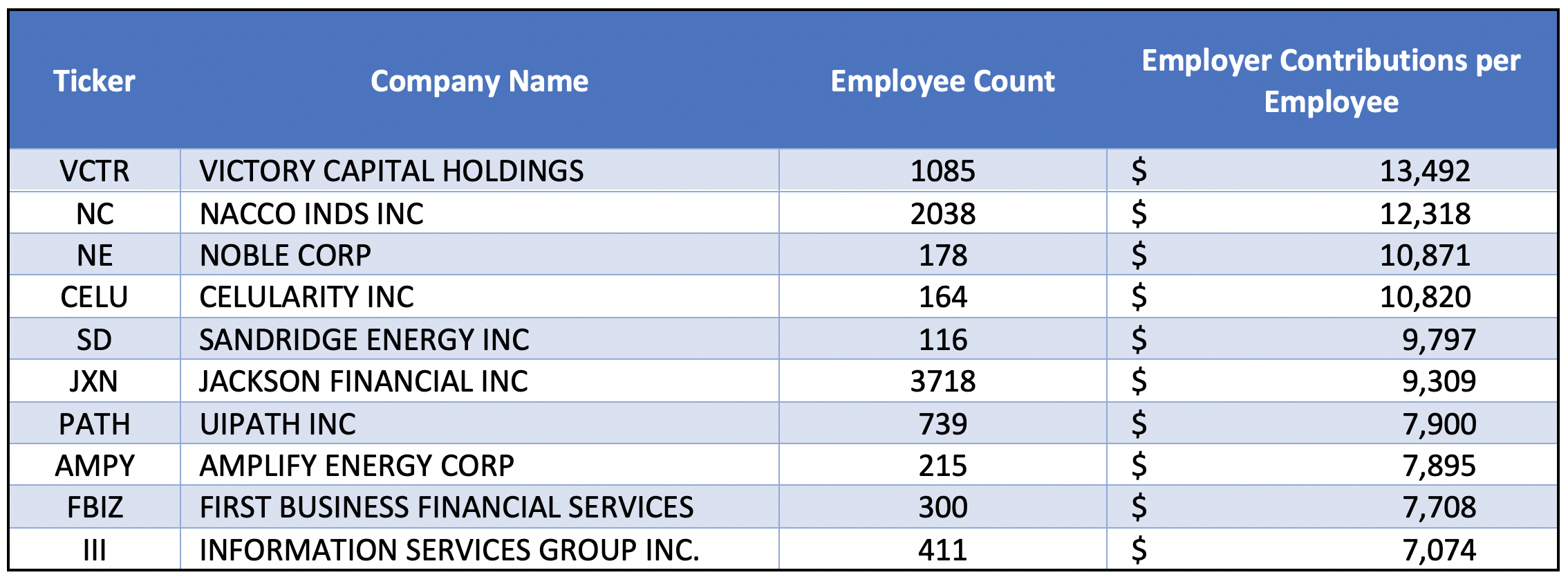

Examining the companies newly added to the Russell 3000 list, below is a table listing the companies with the highest pension contribution per employee. An earlier blog post detailed statistically significant correlations were found between contributions to defined contribution pension plans and corporate financial performance for Russell 3000 companies.

https://www.axiomaticdata.com/blogPosts/whitepaper-pension-contributions-and-finance-performance

About Axiomatic Data

The Axiomatic Data database contains quantitative data on public and private U.S. companies, extracted and aligned from Form 5500 (ERISA) filings. Form 5500 filings are mandated jointly by the U.S. Department of Labor and the Internal Revenue Service. The filings cover employee retirement and welfare benefit plans and are a required filing for all US companies that have over 100 employees or that offer their employees a pension plan. As part of Axiomatic Data’s monthly data runs, we match / map data from Form 5500 filings and associated EINs to the Russell 3000 tickers using our Russell 3000 base file and SEC 10-K filings. Additional data such as secondary name, EIN, and address are mapped from the 10-K filings to the Russell 3000 base file. With the annual Russell reconstitution in June, new tickers were added to the Russell 3000 as part of Axiomatic’s monthly data processes.

The database contains reliable, accurate firmographic and employee benefits information on over 700,000 US companies. Levels of, and changes to employer contributions to employee benefit plans are frequently used as a measure of financial health. It makes sense – companies that regularly increase the contributions they make to employee benefit plans must have the current and future cash flow to afford the contributions. Companies that decrease contributions to employee benefit plans would only do so if they were in, or expected to be, in financial distress.

Below is a link to a data sample of 100 stocks that were recently added to the Russell 3000 during the June reconstitution along with a sample dictionary.

https://www.axiomaticdata.com/samples/axiomatic_sample_100_new_russell3000_2022.xlsx

Additionally, further samples from Axiomatic Data can be found with the below link.