Pension Contributions & Financial Performance

Our first white paper provides evidence of the correlation between corporate pension fund contribution and financial performance.

Key Findings:

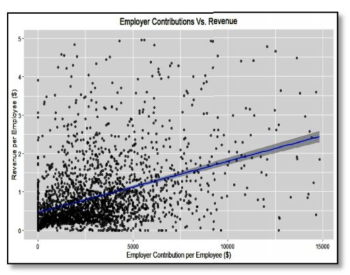

Statistically significant correlations were found between contributions to defined contribution pension plans and corporate financial performance for Russell 3000 companies.

Employer contributions were found to be more correlated with financial performance than participant contributions, consistent with findings from a research paper by T. Rowe Price.

Companies with higher contributions per employee were found to be more likely to have higher revenue and EBITDA per employee, accounting for company size, age, and industry.

Above findings were found to hold for all industry sectors, except Professional, Scientific and Technical Services, which has little correlation between EBITDA and pension contributions per employee.