YoY Industry growth metrics From Form 5500 Filings

The November 2022 US Bureau of Labor Statistics Monthly Labor Review titled Projections overview and highlights 2021-2031 forecasted that:

“Employment and real output are projected to grow during the 2021–31 decade, reflecting both cyclical recovery from the 2020 coronavirus disease 2019 (COVID-19) pandemic-induced recession, and structural growth. About one-fourth of the population will be age 65 or older in 2031, contributing to slow projected growth in the labor force and a continued decline in the labor force participation rate. The aging population is also expected to continue to drive strong demand for a variety of healthcare services, with 2.6 million jobs projected to be added in the healthcare and social assistance sector through 2031.”

This paper examines year-over-year changes in data gleaned from Form 5500 filings that confirms or conflicts with recent projections made by the Bureau of Labor Statistics. From the BLS projections one could surmise that:

- Industries and businesses that were most negatively affected by the COVID-19 pandemic should be showing signs of recovery and growth in the 2020-2021 period.

- Given the ageing population thesis, which has been in effect for some time, healthcare services and social assistance businesses should be growing in employment and business creation at a faster rate than other sectors.

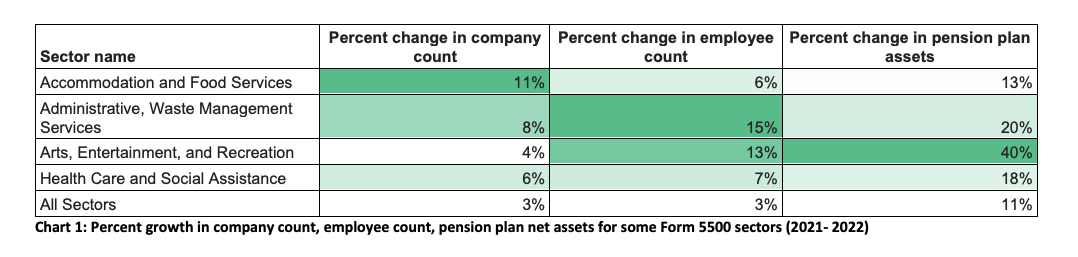

We see from 2021 Form 5500 filings data (Chart 1 below) that while Accommodation and Food Services sector grew most rapidly between Dec 2021 – Dec 2022, there was moderate growth in Health Care and Social Assistance.

Post-pandemic, the recovery and growth in employment for the service-providing industries and occupations that lost jobs during the pandemic constitutes a large component of the YoY growth. For example, industries within the leisure and hospitality sectors were the fastest growing sector as consumption in food services and accommodation returned to pre-pandemic patterns.

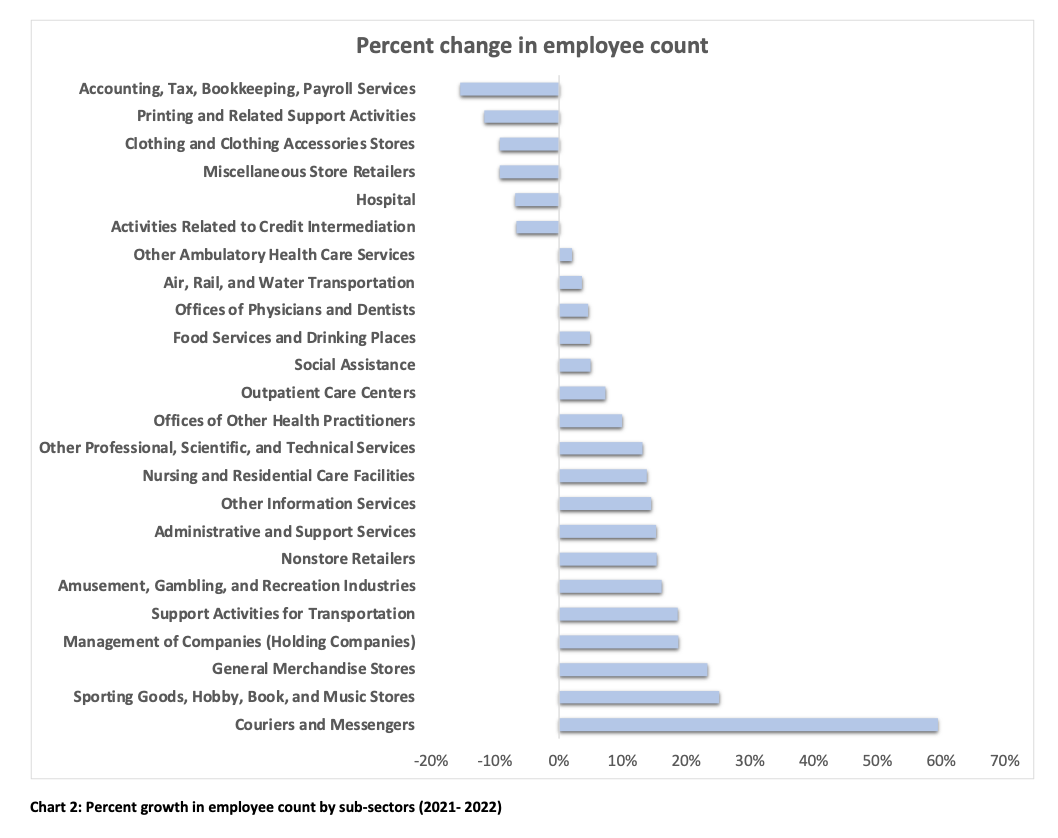

Looking at the percentage growth in employee count by Form 5500 sub-sectors, chart 2 shows that changing consumer preferences during the pandemic has led to strong YoY growth in service-providing sub-sectors such as Amusement, Gambling and Recreation industries, Sporting Goods, Hobby, Book and Music Stores, and Courier and Messengers services post-pandemic. The growth of employee count in Amusement Gambling, and Recreation industries is 16%, indicating that many venues that had closed due to Covid have reopened and are close to business as usual.

Based on the aging population thesis, we see that employee count in Outpatient Care Services grew by 7% while Nursing and Residential Care Facilities grew by14% respectively. The YoY increase in number of employees in following sub-sectors indicates demand spurred by an ageing population:

- Other Ambulatory Health Care Services

- Social Assistance

- Outpatient Care Centers

- Offices of other Health Practitioners

- Nursing and Residential Care Facilities

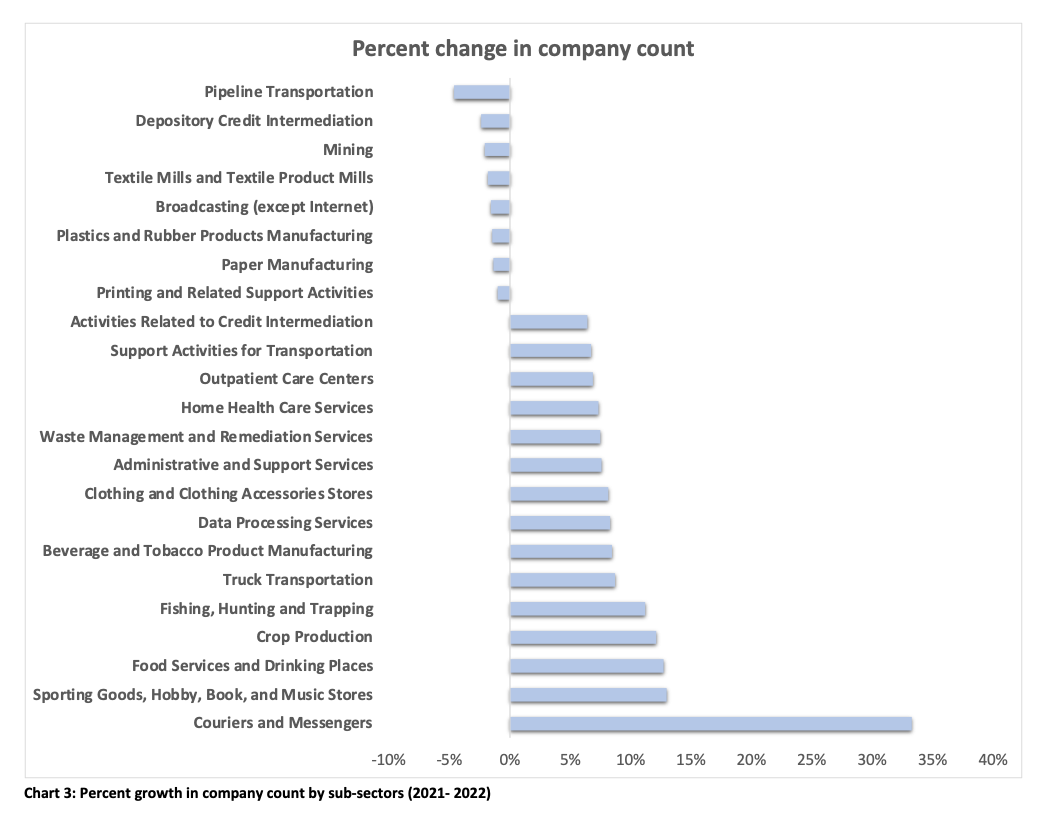

Chart 3 shows the percentage change in company counts by Form 5500 sub-sectors. It is evident that the nature of the pandemic related economic changes and activities increased structural demand for some occupations leading to a long-term structural growth for these sub-sectors. For example, structural shifts in consumer demand for home delivered goods resulted in the largest YoY growth of 33% in company count and 60% growth in employee count for Couriers and Messenger services.

In contrast, cyclical recovery in demand for Food and Hospitality sectors with more people starting to eat out at restaurants post-pandemic, led to a 15% growth in company count and a modest 5% growth in employee count for the Food and Drinking places, one of the most impacted sub-sectors during Covid-19.

Contact info@axiomaticdata.com for more information about how your company can leverage Form 5500 data.